NEW: the Suite now includes our Automated Trader software.

The unique value of Smart Forex Tester Suite 3.0 is that our new software gives you all you need to minimize risk and make a profit in day trading.

Suite 3.0 takes it to a completely new level, thanks to MetaTrader connector. Not only can you run your strategy on any Metatrader data feed (not only Forex!), but you will also be able to use it for real trading – from the same familiar testing software.

The key to building profitable trading strategies is the Pivot Points Analyzer or PPA – our unique algorithm that nails market turning points in real time.

Let us explain how exactly PPA helps you make profits and minimize risk.

We all know that it is impossible to predict market direction.

Still, there is one sure thing in any market: prices ALWAYS move from one extreme to the next. You must have seen this see-sawing everywhere.

Our algorithm can detect these extremes – in real time.

Watch a short video where PPA signals market tops with red dots, and bottoms with blue.

For demonstration purposes, algorithm sensitivity was set to high. If you lower it, there will be fewer signals, but in more essential turning points.

Forget lagging indicators! Use these real-time signals to enter a trade or exit the market – for any trading strategy. The best “buy low, sell high” recipe we know.

For any market action

Markets can only be in one of the two states: they are either trending or not.

The figure below illustrates how you can benefit from the PPA signals in both cases.

Take a look at the upper tick graph. Most of the time in the middle of this time interval, the market is not trending. For such a market, the so-called “return to the mean” strategy works pretty well.

For non-trending market, PPA signals usually go in turns: a top is followed by a bottom, etc. So, you can open short positions at each top (red dot), and long positions at each bottom (blue dot).

Let’s see now how to trade a trending market. In the graph above, there is a mini ascending trend at the beginning of the interval, and a descending one at the end.

Note a remarkable feature of our algorithm: on the trend, the signals become of the same color! There are only tops on the uptrend, while the downtrend has only bottoms.

We can use that – but now we need a trend following strategy. For example, at the top, instead of opening a short position, we can just do nothing and let the profits run.

Trends have enormous profit potential. But to make use of it, you need to open a position in the direction of the trend early enough. And likewise, we shouldn’t be too late to get out when the trend is already exhausted.

This is much easier said than done, and it is very difficult to automate. So, it is beneficial to manually switch between automated strategies, according to the market situation. For example, from “mean reversal” to “follow trend up”.

We are also working on AI-based pattern recognition model that would help to identify the beginning or end of the trend automatically.

Like our new software? Get it instantly, risk-free!

Smart Forex Tester Suite 3.0 in more detail

The big picture: Smart Forex Tester Suite is the ultimate all-in-one software to develop your trading strategy, thoroughly test it and use it in the real market.

Suite 1.0 is already a solid tool to practice Forex any time (even when all demo accounts don’t work), boost your practice with time shifting, automate your trading strategy and test it both on historical and live prices.

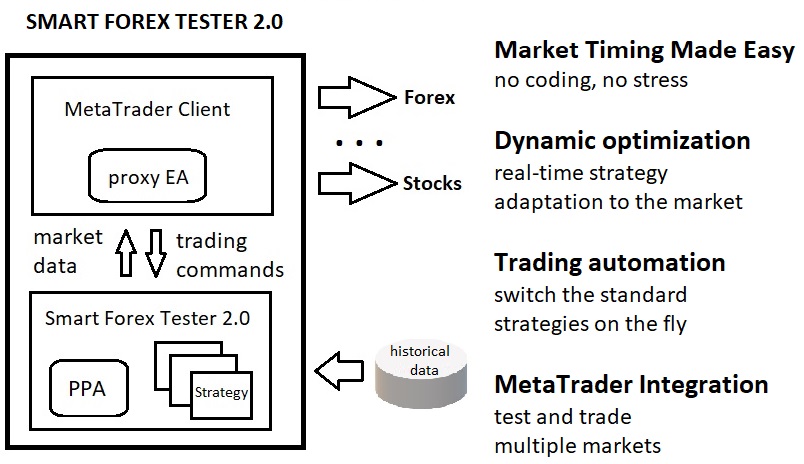

Suite 2.0 inherits all the 1.0 functionality and adds a bunch of advanced features that will enable you to use your tested strategy in real trading.

Pivot Points Analyzer is the principal component of the suite. As you just saw in the above video, it is able to detect market pivot points in real-time.

The detection algorithm is the result of our many years’ research experience in signals detection from the random background noise.

Market Timing made easy

The advantage of our algorithm is in that it works so fast that you can use it for the timing of market entry or exit.

Whereas indicators are principally lagging because they use averaging. Even for a very short M1 time frame, you still need to wait for each reading for 1 min. Which is long enough time for a lot of see-sawing to happen.

Indicators are useful to provide a big picture, but it is nearly impossible to base your trading on indicators only. You can’t buy or sell averages – you have to trade ticks!

For example, even if the RSI shows that the market is overbought or oversold, this condition can stay for a quite long time and even develop further.

PPA signals alone can be used for scalping. A trading strategy can access the signals from its C++ code, and it can enter the market on the same tick a signal arrives. This is way faster and more reliable than you can do yourself.

On the other hand, the detector signals can be part of more complex trading strategies, including indicators-based. Combined signals will let you enter the market much better.

Adding proper market timing to any lagging indicator will give you the best of both worlds. Otherwise, you could lose tens of pips on both entry and exit – because of the seesawing of the market.

Moreover, if a signal turned out not to be a pivot point, good timing helps to minimize the losses.

Because even at local extremes, the market tends to slow down and seesaw – and you might have the time to exit if you are unsure – you may even make a little profit

Adapting to Markets

Trading strategy optimization via backtesting is very popular. In our opinion,

“Trend hacking”

So, early recognition of the emerging trend has enormous profit potential. And we are also working on our AI-based pattern recognition model that would help enter the market to identify the beginning or end of the trend automatically.

Another example would be enhancements of the PPA algorithm that could automatically adjust to asymmetric price action when a trend is developing.

If you recall the PPA video, you remember that the PPA signals on the trend consistently become of the same type. For example, if the market is trending up, PPA almost always calls only the tops (red dots in the video).

The enhanced algorithm will be able to lower the detector sensitivity in the direction of the trend and increase it in the opposite direction.

This way, we can retain current (strong) signals, and add weaker pullback signals. In this case, the trend following strategy could fix the profit when a strong signal is generated, but then re-enter the market in the same direction on a weak signal.

Trading automation

Trading is not a picnic. It is very stressful and can take you a lot of time. Fortunately, automation can help.

When we were just starting with our software, our goal was to develop a fully automated trader to avoid the stress completely. However, after years of development and testing, we decided to only delegate to the software the most time-consuming and stressful parts.

This way, each party does what it’s best at. You can’t beat the algorithm in tireless waiting and reacting with a tick accuracy. However, it is you who should know the big picture better.

But even when you do, formalizing that knowledge into a working computer algorithm is a very difficult task. This was our main reason to go for semi-automation.

A logical next step is to have a set of automated trading strategies for different market situations and manually switch between them on the fly. Let’s discuss some examples.

The most important of all standard strategies would be the one to trade a powerful trend. While trends are rare (about 20% of the time), they have the biggest profit potential. So, you should be using trends as much as you only can.

However, trading a trend is not as easy as it might seem. And also stressful. Here’s why.

The markets never move in a straight line. When you see a pullback, how can you decide whether it is only temporary? Maybe this moment the trend has just ended. Should you try to take your profit now and try to earn more on a sharp counter-trend movement (“catch a falling knife”). And will you even be able to?

All this might be very challenging in a fast-moving market. And our enhancements of the PPA algorithm should be able to help. It will automatically adjust to the asymmetric price action when a trend is developing, and generate the signals in both directions.

Take Profit and Stop Loss orders is yet another example. Have you ever been in a situation when the market reversed just several pips shy of your TP order? Or when the order was triggered – but the market went further for another 20 pips?

On the contrary, even a fairly simple PPA-based strategy can do much better. For example, instead of a static TP order, we can specify a price level to monitor and instruct the strategy to exit only if the market exceeds this level AND reaches an extreme and reverse. A similar idea will work in the SL case, and trailing can be added easily to both.

We hope you see our point in all the examples above. Standard situations. Standard automated strategies. No need to code! You can switch between the ready strategies, set and adjust their parameters – just from the GUI.

And finally, a note for those who can (and do want to) code yourself: if you want to go deeper – absolutely! With the included full-fledged C++ environment you can both build upon the ready strategies and develop your own from scratch; our PPA signals as building blocks will come handy in either case.

Day trade directly from Tester

Thanks to MetaTrader connector, now you can test and trade multiple markets – not only Forex.

The Tester uses a proxy EA to receive the market data and exchange trading commands. As this communication happens on the same computer, the delay it introduces is virtually zero – compared to the rate the market changes. So, even if run on an average office laptop, the Tester can do a lot of computing between ticks.

Meta Trader integration will bring the Tester to the new level. At the push of a button, you will be able to switch between testing and real trading. And use the same strategy you were just testing. From the same testing environment. And while trading, you will be able to make changes in the strategy and reload it on the fly.

If your strategy is not yet ready for real life trading, the MT integration will be also handy for testing. You can use the same real market prices as test data input, but place the orders in the Tester instead.

In addition, you can save the market data from your service provider’s feed to your computer and test on it later on.

And surely, one of the most important advantages of the

Don’t take our word for it!

While we hope that you understand the power of our new software, we think that some of you might not believe all we’ve just said. Or think it all sounds too good to be true.

Fair enough.

We don’t offer you a mystery black box making money for you when you sleep.

This would be irresponsible – there is no silver bullet. The market is unpredictable.

That said, if used properly, our software can definitely help you succeed in trading.

And the good news is that you don’t have to just trust our worlds.

Because the Smart Forex Tester Suite gives you all needed to effectively test yourself every detail of what we presented – before deciding on taking any risks.

Ultimate Strategy Testing Environment

Smart Forex Tester Suite software was launched to our subscribers at the end of 2016. It provides all needed to develop and test your trading strategy.

The Suite’s unique functionality makes it possible to considerably reduce the time required for testing – be it manual or automated.

Trading Simulator is designed for manual testing of your strategies. You can test both on historical tick-by-tick market data and live prices. The Simulator provides 100% market modeling quality with the tick rendering accuracy of up to 1 ms.

If your day job keeps you very busy on weekdays, offline Simulator is a perfect solution. It lets you test at any time, convenient for you. Most importantly, on weekends – when the market is closed and no demo account is of any use.

Offline testing alone makes the Simulator superior to any demo account. But the Simulator also saves your time, due to variable tick data feed speed functionality.

So, doing Fast forward on the slow market, you can skip the dull time – without losing anything! It is like skipping the commercials in a recorded TV series.

Alternatively, using Slow motion feature, you can test on fast markets. For example, during news releases, it might be useful to reduce the data feed speed to up to 1/4X.

In addition, it is the fast moving market when it is interesting to use the trading server delay functionality. The delay is always present in real life online trading and the Simulator lets you model it.

You can also run the Simulator online. Live market data feed gives you real tradable prices for 10 main currency pairs – no account needed. You can use pivot points algorithm to generate real-time market signals and test on the live market.

Furthermore, you can also manage and save your time in online real-time simulation! Thanks to a unique Time Shift feature.

Time Shift lets you pause live data feed whenever needed, so you don’t have to be chained to your computer even during live trading. When you resume, all the offline data speed manipulation options will become available, as well.

This functionality is evidently impossible to get on a regular demo account.

Smart Forex Tester is used for trading automation design and testing, both offline on historical data and on live prices online.

Tester provides 100% accurate market modeling because it only works on real tick data and never interpolates the ticks from M1 bars.

Tester and Simulator use the same data engine, so all the options to vary data feed speed and simulate server delay are also available.

Tester provides full-fledged C++ environment for strategy definition. Pivot Points detection algorithm is made available to strategies.

You can analyze your trades using zoom in function. It shows a snapshot of the market with a tick accuracy – even when the test continues running at the maximum speed.

Tester also provides even more smart functionality to further increase test efficiency and save your time.

So, the Quick test mode lets you get a draft test result much faster when you choose to not use each tick in the data file, but e.g every 2nd or 3rd.

With the Test Manager, you can save the most critical market data as test scenarios and only run tests in batches instead of testing every time on full data arrays.

Summing it up

Smart Forex Tester Suite 3.0 includes 6 cutting-edge software products – all accessible in one GUI.

Here’s what you will get:

OFFLINE Trading Simulator

- 100% market modeling quality

- up to 1 ms accuracy

- Fast Forward – save your time

- Slow Motion/Pause/Resume

- variable trading server delays

ONLINE Trading Simulator

- 10 main pairs w/o account

- Data feed from MetaTrader

- market timing signals

- Time Shift – save your time

Strategy Tester

- C++ Test Automation

- Interface to PPA signals

- quick test mode

- Test Manager

Pivot Points Analyzer

- real-time market timing signals

- signal interface for automation

- parameters optimization

Data Manager

- live price data recording

- tick test data preparation

MetaTrader connector

- Live prices from your MT Terminal

- PPA signals export to MT

- Real trading from Tester

Bottom line

Smart Forex Tester Suite 3.0 is the ultimate strategy testing and day trading tool.

You can practice trading manually – even when the market is closed.

You can develop a profitable automated trading strategy based on PPA signals.

You can test your strategy with 100% accurate market simulator – both on historical data and online.

And finally, do real trading with your automated strategy! Directly from the Tester.

Like our new software? Get it NOW, risk-free!

It’s really very easy to order.

Just click on the below button to order with your credit card

or PayPal online

You will get immediate access – even if it’s 2 AM

After your payment is completed, you will get an email with the link to the download page and the instructions on how to get your license code.

And you don’t have to worry…

Because Your Satisfaction Is 100% Guaranteed!

We want you to feel safe pressing the link and getting our Software.

So here’s the deal:

Get the Smart Forex Tester Suite 3.0 NOW and use it up to 60 days to see what you think.

If it doesn’t live up to your best expectations…

…then just write us an email saying so. We’ll refund your investment ASAP – no questions asked.

Still not convinced?

Including all new products and features that will be added to the Suite. Most importantly, all strategies based on market pattern recognition.

So, for a reasonable one-time payment, you’ll get a bunch of cutting-edge products for a fraction of their real cost, with free updates for life – risk-free!

YES! I want Smart Forex Tester Suite 3.0 For One-Time Payment of $997