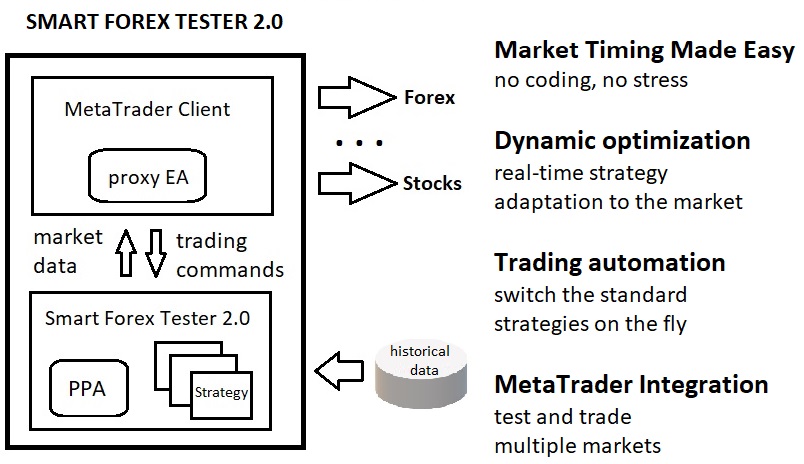

In a nutshell, the theme of the 2.0 series is “Market Timing made easy”. We will be further developing our Pivot Points Analyzer algorithm, working on real-time dynamic optimization, improving trading automation and putting it all to use on multiple markets via the Meta Trader integration. Read on for details.

2.0 series will include all 1.0 features, which you can review here (make sure to watch the video).

Market Timing and Dynamic optimization. Based on Pivot Points Analyzer (PPA), which unique algorithm nails the turning points that always exist in any market – regardless of the time frame. (not familiar with PPA? check this 3 min video).

PPA doesn’t use indicators, and it works very fast – nearly in real-time. Any PPA signal gets available to the automated trading strategy at the same tick when the signal is generated.

This means you don’t have to be glued to your computer – your strategy can monitor the signals for you on the background, and act on them already at the next tick. You can just follow sound notifications.

And you don’t have to be able to code for all that – the signals are provided with a ready code wrapper. In a moment, we will discuss no-coding Trading Automation in more detail, as this is a very important topic.

Now, back to PPA. You might recall the test results we’ve shared in our emails, where a PPA based strategy with static parameters was winning on a month-long Asian trading data or made over hundred pips in an hour on a powerful trend. While these are credible results, we should be aiming for more reliability.

The biggest room for improvement is in increasing the accuracy of the detection by dynamical adjusting the algorithm parameters to the current market conditions. It is evident that the market behavior can differ a lot – so, it seems only logical to consider the back-testing results obtained for the very recent data more valuable than any old ones. Fortunately, now we have all we need to accomplish that.

One possible implementation would be to run the Tester on the background and feed it with the latest data. Given the recent market action, the tester will evaluate a set of the parameters (or even strategies), select those most suitable in the current situation and make the adjustments automatically.

With our advanced testing engine developed already in 1.0 series, especially Fast Test, it is fully feasible to run such testing in minutes. Which is reasonably fast to have time to adjust the parameters to the latest market action.

There are other approaches we could try. For example, run PPA on the background and constantly adjust its parameters so that its current results would match the already detected extremes – retroactively corrected.

Last but not least, we will also be further researching the detection algorithm itself.

Trading automation. Trading is not a picnic. You might have to wait for a market opportunity for quite a while. When your chance finally comes, you shouldn’t waste it. This all is very stressful and can take you a lot of time. Fortunately, automation can help.

When we were just starting with our software, our goal was to develop a fully automated trader to avoid the stress completely. However, after years of development and testing, we decided to only delegate to the software the most time-consuming and stressful parts.

This way, each party does what it’s best at. You can’t beat the algorithm in tireless waiting and reacting with a tick accuracy. However, it is you who should know the big picture better. But even when you do, formalizing that knowledge into a working computer algorithm is a very difficult task.

This was our main reason to go for semi-automation. A logical next step is to have a set of automated trading strategies for different market situations, and manually switch between them on the fly. Let’s discuss some examples.

The most important of all standard strategies would be the one to trade a powerful trend. While trends are rare (maybe 20% of the time), they have the biggest profit potential. So, you should be using trends as much as you only can. However, trading a trend manually is not as easy as it might seem. And also stressful. Here’s why.

The markets never move in a straight line. When you see a pullback, how can you decide whether it is only temporary? Maybe this moment the trend has just ended. Should you try to take your profit now and try to earn more on a sharp counter-trend movement (“catch a falling knife”). And will you even be able to? It might be challenging in a fast-moving market.

The software can help at least with the latter. The dynamic adaptation for the PPA algorithm that we’ve already discussed should be able to automatically adjust to the asymmetric price action when a trend is developing. If you ever tested PPA on a trend (or just recall our PPA video), you can better understand it.

The video was recorded for 1.0 software where the detector parameters are constant. You can note that the PPA signals on the trend consistently become of the same sign. For example, on the uptrend, PPA signals almost only tops (red dots in the video).

This nice feature of the algorithm can be used as a signal itself. We can lower the detector sensitivity in the direction of the trend, and increase it in the opposite direction. This can help you to trade the pullbacks, which can be very sharp.

“Trend hacking” could be another example. How often could you witness the swift action of the market moving from a level to the next? Not very often, right? Which is no wonder, as the transitions between levels usually happen very quickly. At least compared to the time the markets can spend threading water around these levels.

How can we catch the movements like that? Chances are, this swift action is preceded by an extreme in the opposite direction and PPA can signal it to us. So, if we are lucky, we can enter the market just before the major movement. Even if we are not, this is not yet disastrous as such: most PPA signals indicate a local extreme, where the market spend time see-sawing. So, you have time to get out with small losses – or even win.

Take Profit and Stop Loss orders is yet another example. Have you ever been in a situation when the market reversed just several pips shy of your TP order? Or when the order was triggered – but the market went further for another 20 pips? This is how it often happens when you use static (or even trailing) orders. To say nothing of the stop loss hunting by the brokers or the horror stories about the SL orders not getting triggered in a volatile market.

On the contrary, even a fairly simple PPA-based strategy can do much better. For example, instead of a static TP order, we can specify a price level to monitor and instruct the strategy to exit only if the market exceeds this level AND reaches an extreme and reverse. Similar idea will work in the SL case, and trailing can be added easily to both.

We hope you see our point in all the examples above. Standard situations. Standard automated strategies. No need to code! You can switch between the ready strategies, set and adjust their parameters – just from the GUI.

And finally, a note for those who can (and do want to) code yourself: if you want to go deeper – absolutely! With the included full-fledged C++ environment you can both build upon the ready strategies and develop your own from scratch; our PPA signals as building blocks will come handy in either case.

Meta Trader Integration. Test and trade multiple markets – not only Forex.

You know that the market modelling in our Tester is 100% accurate. Given high quality historical market data, the Tester is enough as a stand-alone tool to develop, evaluate and automate your trading strategy.

Meta Trader integration will bring the Tester to the new level. At the push of a button, you will be able to switch between testing and real trading. And use the same strategy you were just testing. From the same testing environment. And while trading, you will be able to make changes in the strategy and reload it on the fly.

The Tester will use a proxy EA to receive the market data and exchange trading commands. As this communication happens on the same computer, the delay it introduces is virtually zero – at least compared to the rate the market changes. So, even on an average office laptop, the Tester can do a lot of computing between ticks.

If your strategy is not yet ready for real life trading, the MT integration will be also handy for testing. You can use the same real market prices as test data input, but place the orders in the Tester instead.

In addition, you can save the market data from your service provider’s feed to your computer and test on it later on.

And surely, one of the most important advantages of the integration will be the opportunity to use the same market timing algorithm not only on Forex, but also on other markets that your broker provides you the access to.

If this all makes sense to you and you would like to get this software, click here.